BUG: Delivery Note doesn't have quantity column in document ĩ. BUG: Bill reports export default save directory Ĩ. FIX: E-way Bill Json shows invoice number prefix ħ. Improvement: PAN added in clients report export file Ħ.

Improvement: Export clients with balance ĥ.

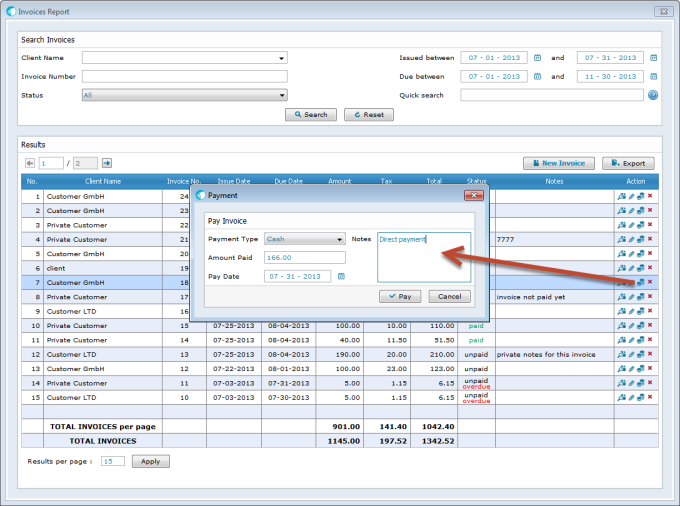

Improvement: Document number prefix in Bills Ĥ. Improvement: Hide columns feature in GST template model 4 ģ. Improvement: CGST/SGST or IGST based on clients "Bill to" stateĢ. FIX: New Company screen changed to 2 screens Ģ4. BUG: Ability to add invoice in old Fiscal year with no errors Ģ3. BUG: json for eway sometimes had errors with ship to data Ģ2. BUG: Purchase order cgst/sgst/igst based on bill to state Ģ1. BUG: Bill - auto generate next document number Ģ0. BUG: GST template 4 column label did not take from preferences ġ9. BUG: Payment documents could not be emailed ġ8. BUG: Inclusive taxation calculation error when cess added ġ7. BUG: Scaling issue on Resolutions with Windows zoom enabled ġ6. FIX: Jammu & Kashmir state removal and 2UTs added ġ5. FIX: Dadra and Nagar Haveli / Daman and Diu merged into new UT ġ4. FIX: Template 4 option to hide disc column added ġ3. Improvement: Notes in Payment documents - "Mark as default" option added ġ2. Improvement: Option to rename Purchase Order title label ġ1. Improvement: Invoice Export report now has TDS, TCS, PAN columns ġ0. Improvement: Debit Note added to In&Out Inventory Report ĩ. Improvement: "Bill To" label added in Model 4 template Ĩ. Improvement: Prefix can now be set with different default for each document type ħ. Improvement: A4 template added to Payment documents Ħ. MOD: Fiscal Year function modified to be automatic and now has option to reset document numbers automatically ĥ. Feature: Add and Track Expenses from Sleek Bill dashboard Ĥ. Feature: TDS/TCS + TCS(206C) implemented ģ. BUG: Error message appears if you try to overwrite 245 diretory - FOR THIS CASE PLS INSTALL IN A SEPARATE FOLDER 2.4.6 - December 16th 2020Ģ. BUG: Reset document numbers manual button did not always work Ħ. BUG: Traditional taxation: old taxes removed Ħ. BUG: Traditional taxation: Expense report not always appearing ĥ. BUG: Traditional taxation - Bill Creation fixed Ĥ. BUG: Traditional taxation - New Payment Creation fixed ģ. BUG: GST - TCS206C no longer applied on shipping fees Ģ. BUG: CREDIT NOTES did not appear in some payment options Ĩ. FIX: Gstr1 report update with rate column ħ. FIX: Prefix length to 13 for secondary documents Ħ. Improvement: PAN added in clients report export file ĥ. It is just for internal tracking and should be converted to receipt when invoice is made Ĥ. Do note this is not considered in statements or GST reports. Feature: Advance payment feature for internal tracking.

Feature: New client/vendor statement report Ģ. 2.4.8 - Novemeber 12th 2021 Update from hereġ.

0 kommentar(er)

0 kommentar(er)